#008: Longevity Investing Intel from ARDD 2020 Conference

Deep Longevity "goes public". Jim Mellon x ARDD 2020. Macro Time.

In this Edition of Longevity Marketcap Telemetry

Notable Last Week

Longevity Futures

The newest longevity stock: Regent Pacific x Deep Longevity. Is it a buy?

Key Insights from Aging Research and Drug Discovery 2020

Technical Analysis

*Disclaimer: None of this should be taken as financial advice. This information is for education purposes only.

**WARNING: Investing in biotech is risky!

-Nathan Cheng // LongevityMarketcap.com // LongevityList.com

Notable Last Week

Investing

Deep Longevity Inc “goes public”. The 3-week-old aging biomarkers AI spinoff from Alex Zhavoronkov’s Insilico Medicine was acquired by Hong Kong-listed microcap Regent Pacific Group for ~ 3.7 million USD.

The company stated in a press release: "Our long-term vision is to transform Regent Pacific into a global end-to-end longevity and wellness biotechnology company dedicated to extending healthy productive lives of billions of people worldwide by developing a longevity ecosystem.”

Shares of Regent Pacific traded up 75% after the acquisition. Is this a legit longevity stock to invest in? Read on for more analysis.Aging Research and Drug Discovery 2020 Virtual conference. Talks by many of the top researchers and investors in longevity. If you missed out, don’t worry. Read on for all the juicy intel I gathered from the conference.

Lineage Cell Therapeutics (LCTX) CEO Brian Culley interview on The Simple Biotech Podcast. The CEO of the pluripotent stem cell therapy company (listed on LongevityMarketcap.com) discusses the technology they are developing on James Ruhle’s excellent podcast.

Trading

XBI Biotech index was -3.2% for the week. Longevity stocks were mostly down as well. Nasdaq and SP500 suffered losses in a big volatility spike on Thursday. Bitcoin also down. Gold and gold miners topped out weeks ago.

Deep Longevity’s acquirer, Regent Pacific, rises 75% after announcing the acquisition. See technical analysis.

Longevity Futures: What to look for in the Next Weeks

Investing

Longevity Investors Conference October 1st, 12:05 PM CET, (Virtual). Just noticed that registration has been opened up. The first two talks are free, the rest of the conference is VIP ($395 per ticket until September 30th). Added to the already impressive lineup: Dr. Joon Yun, Eric Verdin (Buck Institute), and Phil Newman (longevity.technology).

Lineage Cell Therapeutics to present new and accumulated OpRegen data from the ongoing Phase 1/2a clinical trial at the American Academy of Ophthalmology (AAO) Annual 2020 Meeting the second week of November.

Trading

Next few weeks seem more like a macro driven situation given the recent sell off in markets. Technical analysis on a per stock basis is going to be pretty useless right now. I would be watching the 10-year Treasury yield and possibly gold miners (GDX) for clues. See Technical Analysis for some general market observations.

Deep Longevity Inc: The Newest Stock on the Longevity Block.

The past few weeks must have been a wild one for AI drug discovery startup Insilico Medicine’s founder and CEO, Alex Zhavoronkov.

Three weeks after he announced a new aging biomarker spinoff, Deep Longevity Inc, the new company was acquired by a publicly-listed Hong Kong company, Regent Pacific. Zhavoronkov will stay on as Chief Longevity Officer.

Let’s do a deep dive on Insilico Medicine, Deep Longevity (spinoff), and Regent Pacific (acquirer) to make sense of the buyout. Is Regent Pacific an investible longevity stock now?

What is Insilico Medicine?

Insilico Medicine is an AI drug discovery startup founded by Alex Zhavoronkov — a well known figure in the longevity industry. The company is also backed by a number of high profile investors including Juvenescence, Bold Capital Partners, Lilly Asia Ventures, Baidu Ventures, and WuXi AppTec.

Insilico Medicine uses AI algorithms like generative adversarial networks (GANs) and reinforcement learning to generate novel compound candidates that might be active against certain drug targets. It’s like deepfakes but for pharmaceutical drugs.

In September last year, Insilico Medicine published a paper in Nature Biotechnology demonstrating their AI technology in discovering small molecules that might inhibit DDR1 kinase (an enzyme linked to fibrosis).

What is Deep Longevity Inc?

Deep Longevity Inc is a spinoff of Insilico Medicine that focuses on using deep learning techniques to find biomarkers of aging. These biomarkers can be combined to create multi-factorial biological aging clocks. Longevity drug development companies can use them as possible indicators of the activity of their compounds in slowing or reversing biological aging.

Wellness clinics, such as their partner and investor Human Longevity Inc, can also use these biological aging clocks to gauge changes in patient health or performance over time.

Check out Alex Zhavoronkov’s interview on Nick Engerer’s Longevity Blog about Deep Longevity.

What is Regent Pacific Group Holdings?

Regent Pacific, a Hong Kong-listed company, acquired Deep Longevity last week for ~3.7 million USD (paid out in shares of Regent Pacific). This represented an estimated 18.7% dilution of the company issued shares.

Regent Pacific Group Holdings (as of Friday after close)

Marketcap: ~47 million USD

Price per share: $0.017 USD

Main business: Aside from Deep Longevity, their main business asset is the topical drug Fortacin, a treatment for male premature ejaculation.

Regent Pacific stated in a press release: "Our long-term vision is to transform Regent Pacific into a global end-to-end longevity and wellness biotechnology company dedicated to extending healthy productive lives of billions of people worldwide by developing a longevity ecosystem.”

Why Regent Pacific?

At first it seems odd that an unknown premature ejaculation drug company would buy out an AI company like Deep Longevity.

But get this:

Turns out that the largest shareholder of Regent Pacific (at 31% ownership) is none other than British billionaire and patron saint of longevity investing himself, Jim Mellon. In fact, Regent Pacific was one the first companies Mellon started back in 1992 as an emerging markets investment vehicle.

Mellon already owned a part of Deep Longevity as an investor in Insilico Medicine (through Juvenescence). Given Deep Longevity is only 3 weeks old and the identity of the largest shareholder of Regent Pacific, it seems highly likely that this spinout-buyout was planned together in advance.

The question is why “go public” with a Hong Kong company now?

Hong Kong listed shares don’t quite have the same accessibility as NYSE or NASDAQ listed shares.

Investors in Deep Longevity were given shares in Regent Pacific as consideration. Did they really want to own a slice of a premature ejaculation drug business in addition to Deep Longevity? Answer: They probably don’t care because their investment in Deep Longevity is a drop in the bucket compared to their other investments.

It’s possible that Deep Longevity’s public listing is a test run for the Juvenescence IPO — gauging retail appetite for new longevity stock listings.

But the most likely explanation for Deep Longevity’s spinoff-buyout was for the same reason many other startups are rushing to do IPOs or SPACs (special purpose acquisition companies): The market is frothy and retail hype-driven. And they want to get a slice of that sweet sweet liquidity.

It worked.

Despite issuing new shares to acquire Deep Longevity, Regent Pacific was trading up 75% on Friday in Hong Kong when most other shares were down. And if the hype continues they will be able to issue more shares to raise capital with ease.

Will I buy Regent Pacific?

I like Alex Zhavoronkov — he’s all in on longevity.

I like Deep Longevity — it’s a nice “sell the shovels” play in the gold rush of longevity drug discovery.

Under normal circumstances I wouldn’t mind making a small investment commensurate with Deep Longevity’s modest valuation at 3.7 million USD.

However, I’m not so enthusiastic about owning a slice of Regent Pacific’s main business of premature ejaculation treatments. It might be a very profitable niche, but I just don’t know anything about it (not a humble brag).

Verdict: I will make a small symbolic investment in Regent Pacific. As the company’s longevity business strategy unfolds I can always increase the size of the position.

*Note: Hong Kong listed shares usually have a minimum lot size buy in — probably 100 or 500 shares in this case.

Aging Research and Drug Discovery 2020: Jim Mellon and Juvenescence.

Jim Mellon, billionaire longevity investor, gave an excellent talk on Day 4 of ARDD 2020 last week. Here are my notes and main takeaways.

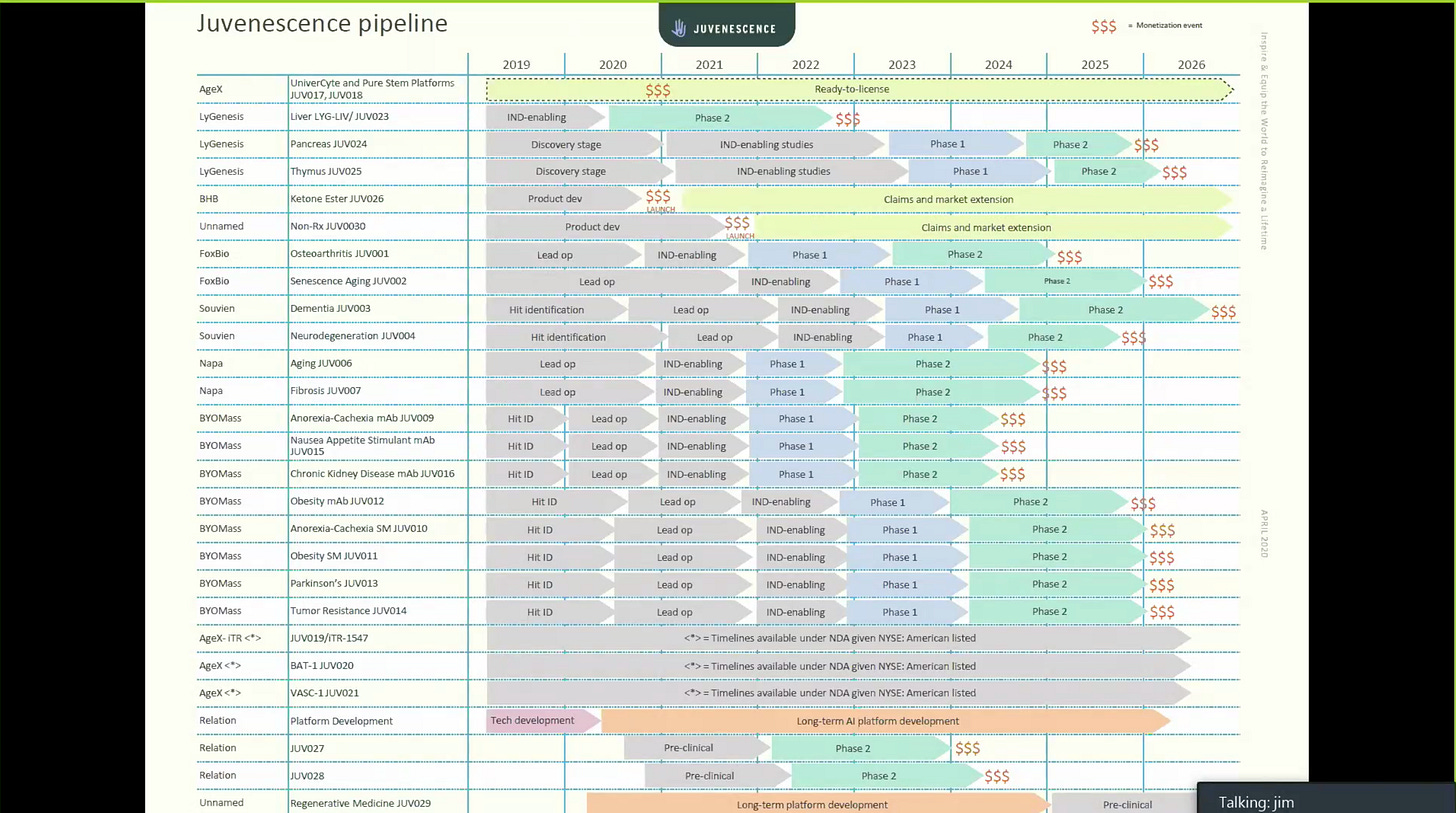

“We want to have chips on as many numbers as possible.” Diversification is key in longevity investing. The figure above shows how Juvenescence has spread their capital on so many different bets. Mostly pharmaceuticals but they also have AI machine learning plays and non-Rx supplements / nutriceuticals.

“We only need one or two products to have great financial success.” I think some people are discouraged to invest in high risk ventures or start their own businesses because they think about success only in frequency space:

”Only 10% of small business succeed” etc — same applies to drug trials. But risk should be considered in terms of payoff space instead of frequency space: It’s okay to lose small many times as long as you win big at least once.Juvenescence IPO will come in a year or so “at the latest”. NYSE or Nasdaq listing. This is big news if true. Juvenescence has an amazing portfolio of longevity companies and an incredible leadership team including Jim Mellon, Greg Bailey, and Declan Doogan (ex-head of drug development at Pfizer). I am keen to invest in them. The only way I could see this IPO getting derailed is if the markets take a big tumble in the next year.

Launch of Metabolic Switch (ketone ester) October 1st. Juvenescence wants to bring some pro-longevity nutriceuticals to market as quickly as a possible. Metabolic Switch looks like a product similar to H.V.M.N’s Ketone Ester drink, which may appeal to athletes and ketogenic diet practitioners. They project to reach $100 million in annual sales.

Juvenescence is looking to add bets on gene therapy and gut microbiome. These are two very hot fields right now. Insilico Medicine recently developed an aging clock based on gut microbiome sequencing.

Juvenescence is not a passive investing company. It would be incorrect to view them as just a holding company or passive ETF. They aim to add value to their portfolio companies via shared accounting services and Insilico Medicine’s AI pipeline. It’s really a more-than-the-sum-of-the-parts sort of deal.

Most excited about LyGenesis. Jim’s enthusiasm for their lymph node-liver regeneration investment was obvious, especially given their recent positive results in pigs, upcoming clinical trials, and potential for the regenerating the thymus / immune system. Juvenescence owns 50% of LyGenesis.

Technical Analysis

Normally this is the section of the newsletter where I would analyze interesting charts of various longevity stocks.

However, the main driving force next week will be macro in nature since basically everything violently sold off on Thursday and Friday. Using technical analysis to divine single stocks will be useless — everything will be coupled to the SP500 and Nasdaq.

If downwards momentum starts to reverse it might be a good opportunity for me to finally buy the longevity stocks missing in my portfolio (see Newsletter #007). The risk here is that stocks continue to dump after September.

Normally I stay clear of macro-bullshitting but let’s just see what the indicators are suggesting.

The VIX

The VIX is a measure of expected volatility in the SP500. It’s also known as the “fear index”. Typically it spikes when the SP500 crashes.

I love using TD sequential to trade the VIX (via VXX). For some reason it works really well. Look at how the weekly and daily TD indicators timed the March top perfectly.

Many people were shocked by the sudden sell off on Thursday and Friday. But if you had been watching the weekly VIX, you wouldn’t be surprised. The VIX declined non-stop in an 8-week trend, down nearly 50% from its most recent peak in June. Both the SP500 and Nasdaq were also well above their 200 day moving averages, bordering on bubble like levels.

So what’s next in for volatility? The last time we saw a daily green TD 8 was back in late February. Volatility declined for a 1 to 4 candle correction before shooting straight up for the high score.

Next week will be critical for the weekly VIX. If it ends in the green then this could mean a start of a trend for more volatility in September. But if it ends well below 30 I would be more optimistic on the markets.

SP500

The blow up in the SP500 on Thursday was the culmination of a triple TD 9 sell AND a weekly TD 9 sell. It was also 16% above its 200 day moving average —the last time that happened was slightly before the Dotcom bubble.

Perfect storm.

As per the TD sequential system we can expect at least a 1 - 4 week correction from here.

Gold

Gold had a daily, weekly, and monthly TD sell indicator all line up basically in August - September. I ended up trimming my position in early August above $2000 / oz.

My family members suddenly asking me about buying gold was also a great topping indicator.

The chart of gold on the daily scale now shows a hideous-looking descending triangle with a resistance at $1920 which I am expecting will be broken to the downside.

The TD 9 sell monthly indicates we can see a 1 - 4 months correction in gold at least.

10-year Treasury Yield

Everyone thinks the SP500 is the market to watch.

But I think the 10-year Treasury yield chart is the most fundamental of all fundamentals.

We have been in a 30-year bull market for bonds as interest rates have been trending down since the 80s. Most of the justification of the valuation of high asset prices in the past decade have been based on the idea that interest rates will be low forever.

But yields started rising in 2018 as the Fed tightened rates. Then the 10-year yield touched the 200-month moving average (never broken since the 80s), the repo market blew up overnight rates, and the markets eventually puked out a lung end of year.

Jerome Powell lost his nerve and started cutting rates in 2019. Covid came and pushed yields further to new all-time lows.

But now it looks like yields have started to bottom in August. If yields are higher by end of this month it could be the start of a new trend. But I think the party won’t really get started until it breaks through some key moving averages (200-day SMA for starts — maybe end of October).

The Fed minutes are giving everyone a heads up that they are going to keep rates low and let inflation get a little hot. They don’t want anyone freaking out with the h-word if/when the CPI breaks through 2%.

Unfortunately, the Fed might not be able to keep rates low and inflation warm at the same time. Higher rates might be necessary if they lose control of inflation. Perhaps all roads lead to stagflation.

-Nathan